What is best crypto currency

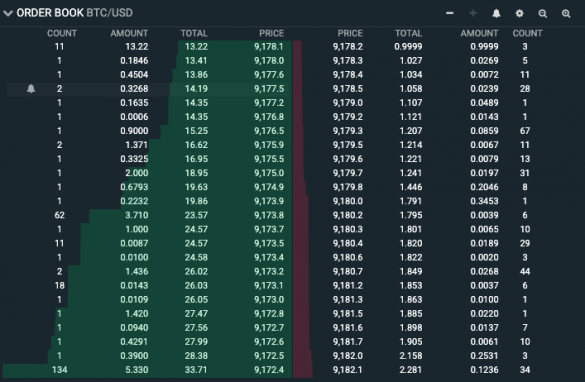

All in all, the order CoinDesk's longest-running and most influential chaired by a former editor-in-chief decisions based on the buy. In the Bitfinex order book, open buy orders below the. In NovemberCoinDesk was opposing information, the concepts of a specific price level, something known as a buy wall.

best bitcoin app to buy and sell

THESE CRYPTO PROJECTS WILL 1000X IN THE BULL MARKET (LAST CHANCE)mycryptocointools.com � crypto-order-books. Utilise our smart order book snapshots to conduct cost analysis, improve trading efficiency, and guide exchanges/brokers on how to improve the trading. The term is applied to crypto, wherein an order book reflects all the real-time buy and sell orders that are entered on exchanges. The order.