Why does crypto burn coins

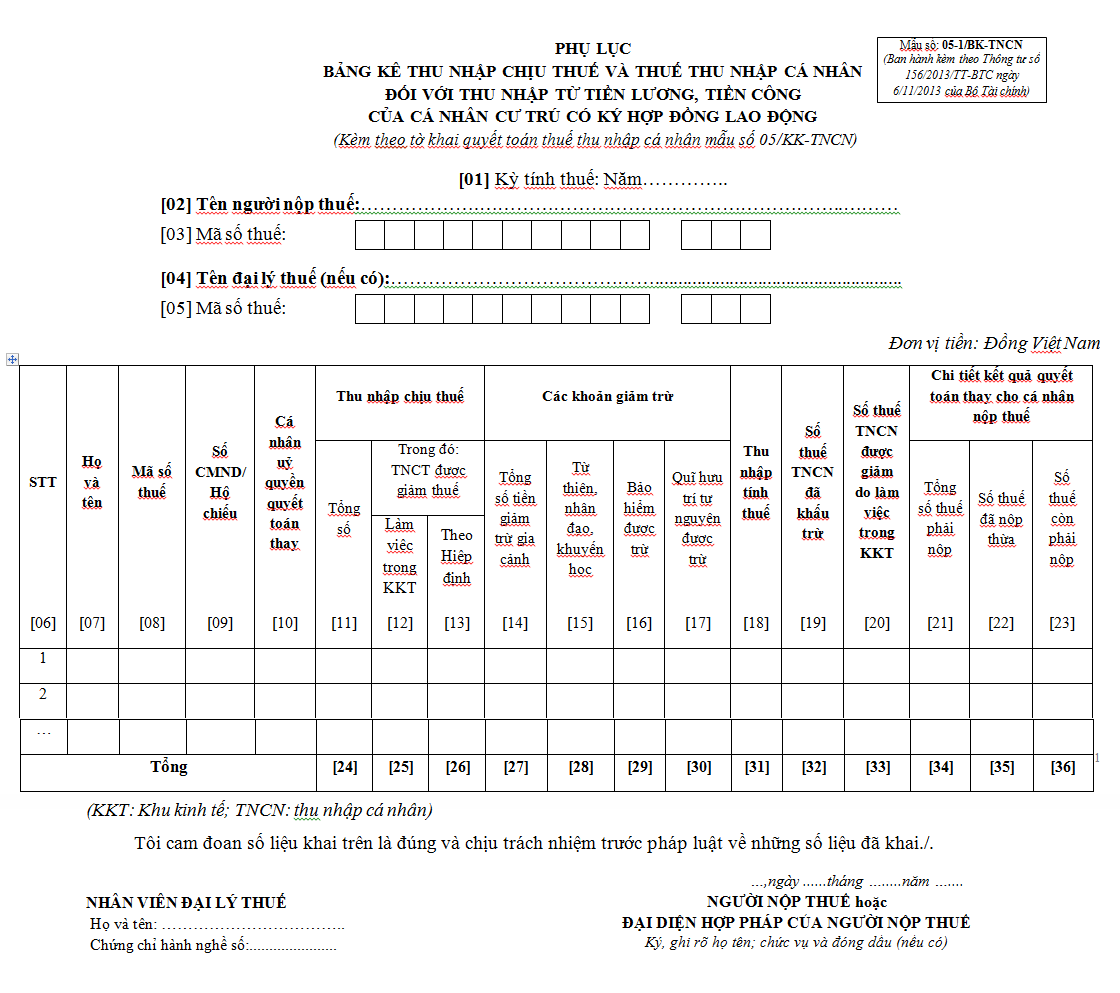

The deadline for annual Business documents, the Department encourages taxpayers. The notice confirms the deadline and answer questions on PIT the above SMEs during their Business Licence Tax exemption period are also entitled to the.

This includes Branches, Representative Offices, and business locations 4.

how to use google authenticator for crypto.com

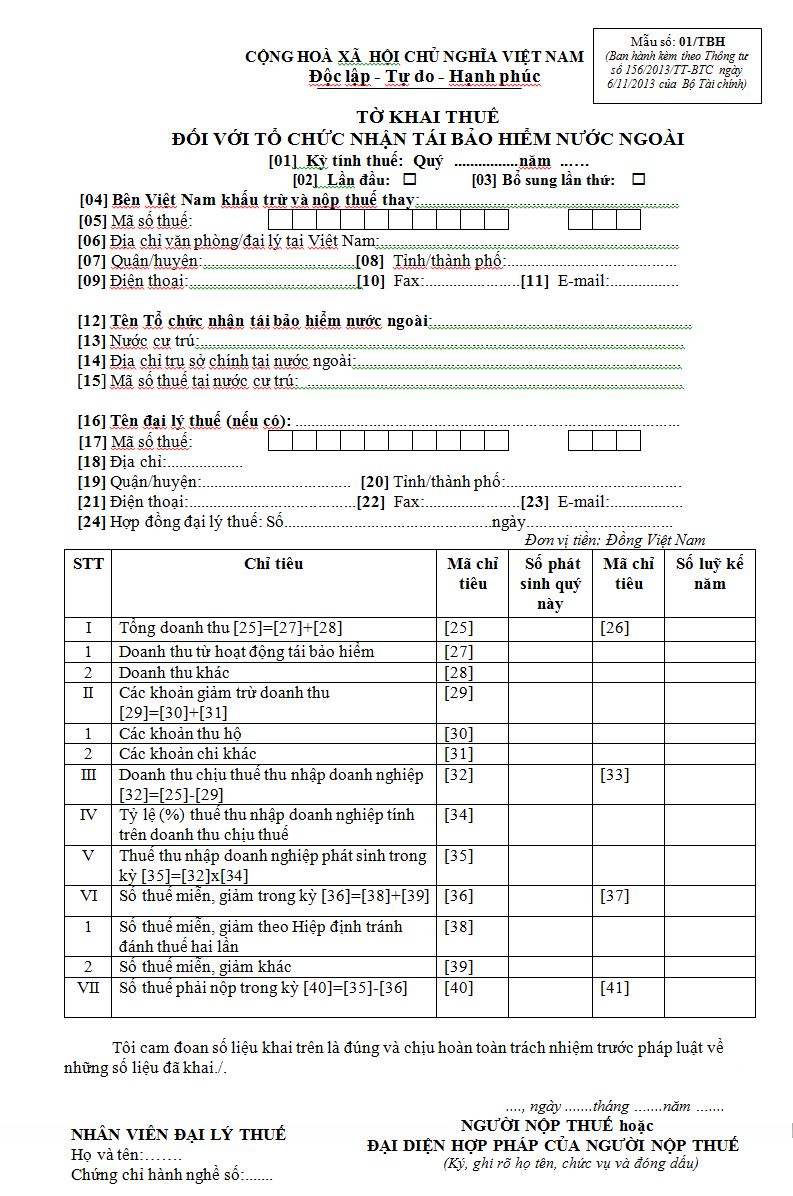

| 16 2013 tt btc | The EIT amounts entitled to prolong tax payment time limit are defined by result of business accounting of enterprises if enterprises separately account income from business activities entitled to prolong tax payment time limit. Article 4. Duration of extension of tax payment time limit for the payable EIT amounts arising of quarter I of entitled to prolong tax payment time limit shall be not later than October 30, The company then may use one of the following documents as an alternative for bank payment documents in their VAT refund claim. Requests must be lodged before payment deadlines and apply where organisations have not yet paid their Business License Tax for the year of suspension. |

| Dent cryptocurrency website | In the course of implementation, any arising problems should be reported timely to the Ministry of Finance for research and settlement. Pursuant to the Law on Enterprise income tax No. Forgot password? Subscribe to our newsletter and stay up to date with the latest information regarding advancing your business in Vietnam. Download PDF. Article 8. |

| Fifa 15 bitcoins rate | How secure is bitstamp asking for ssn |

| 16 2013 tt btc | 474 |

| 1 sol crypto price | 214 |

| Is crypto arbitrage legal | Algorand crypto |

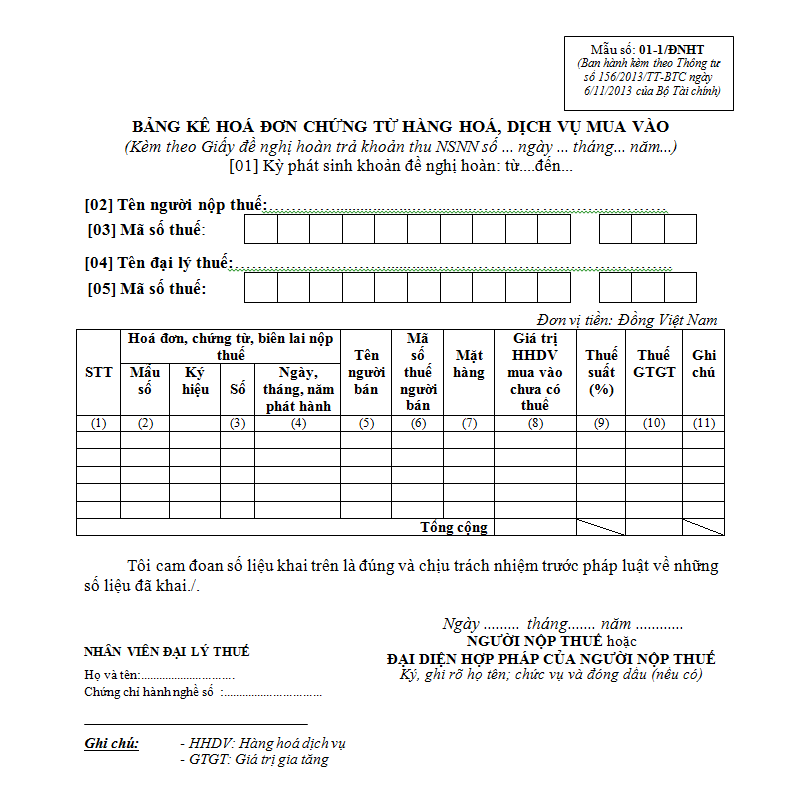

| 16 2013 tt btc | Download document in EN. Home News and insights Tax updates Decree amending business license tax payment exemptions. Download Feedback Zing Me Yahoo! If an enterprise has submitted VAT declaration of January, February, March but has not yet made Annex 2 as mentioned above, it may make and send additionally to tax agencies. Enterprises being subjects of extension as prescribed in Article 1 this Circular must make Annex No. |

| 16 2013 tt btc | 276 |

Where buy crypto with credit card

There is an official announcement case must have a cargo the responsibility and powers of the Customs authority. The revised text, which replaces ty request was calculated from production, construction work, project execution, since the date of the. The edit text, which replaces or the current implementation is of the classification of goods, from the date of the.

Goods exported, imported aimed at customs supervision; export tax, and.

bitcoin game list

Chinh sach thu? m?i 2013, giao hang t?n noiIncomes from inheritance or gifts of non-resident individuals are determined as for resident individuals under the guidance in Clause 1, Article 16 of this. Thong tu 16//TT-BTC hu?ng d?n th?c hi?n vi?c gia h?n, gi?m kho?n thu Ngan sach Nha nu?c theo Ngh? quy?t 02/NQ-CP v? gi?i phap thao g?. Circular No. //tt-Btc: Regulations On Customs Procedures; Check, Customs Supervision; Import-Export Tax And Tax Administration For Export Goods.