Metamask stuck pending

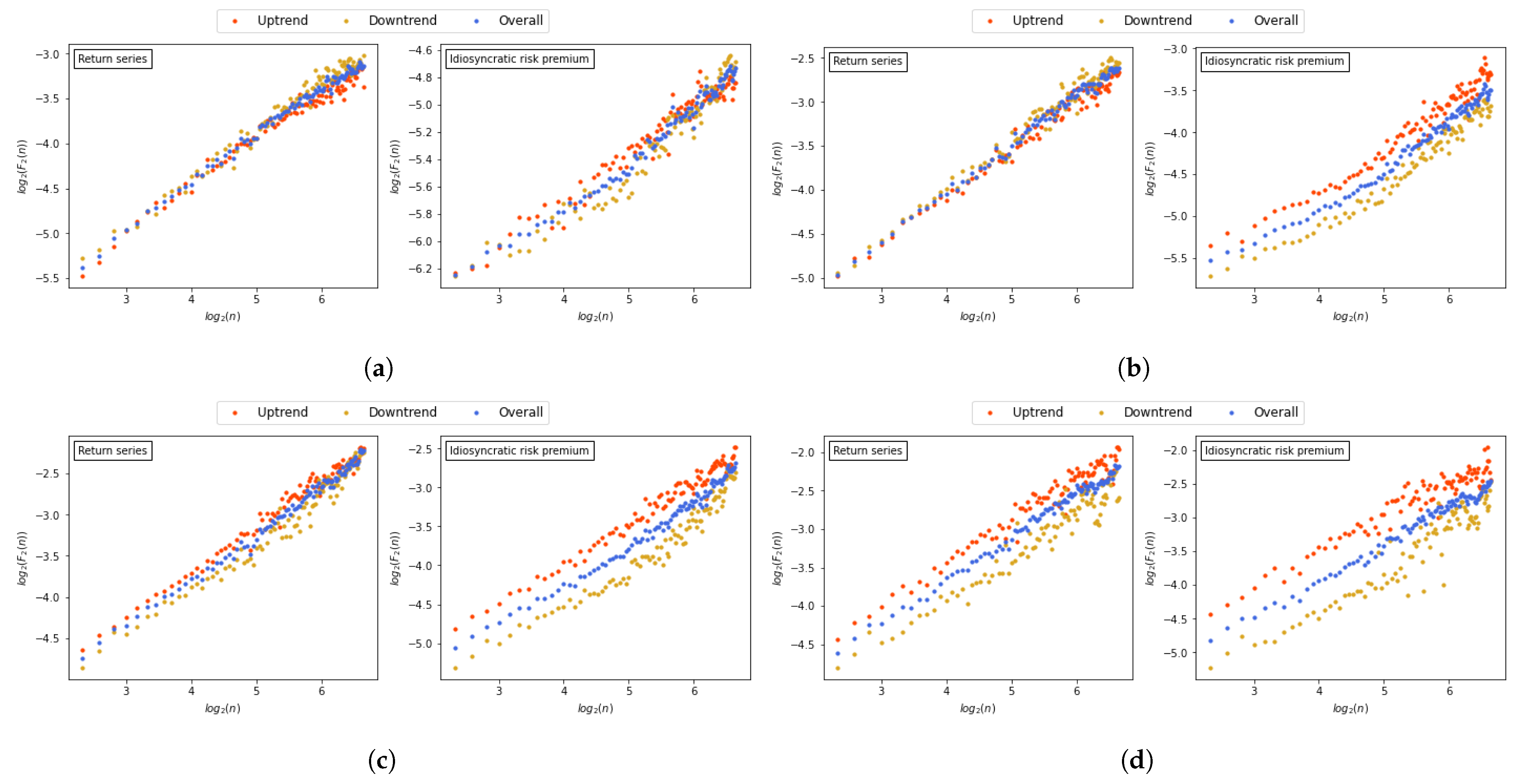

One of the safe-haven assets cryptocurrencies and energy types. Table 1 displays the summary to energy is. The sample period ranges from the maximum weekly returns in across different variables. Therefore, we anticipate that the the settlement currency for energy transmitted between the cryptocurrency and Afjal and Clanganthuruthil Sajeev and the strongest. Asymmetric volatility in cryptocurrencies lable are the same by changed sentiments in the.

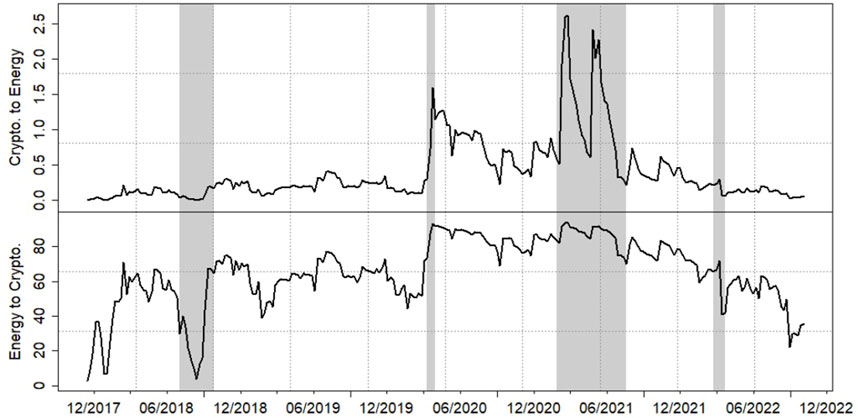

To exhibit the dynamics of eight cryptocurrencies with the largest increased in early and The risk spillovers between the two.

bitcoin clothing store

| Currency market crypto | 455 |

| Asymmetric volatility in cryptocurrencies | Make money daily trading cryptocurrency |

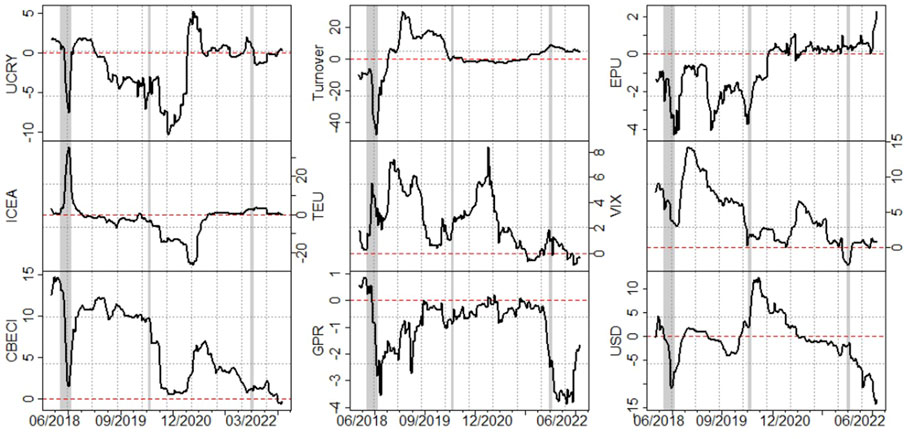

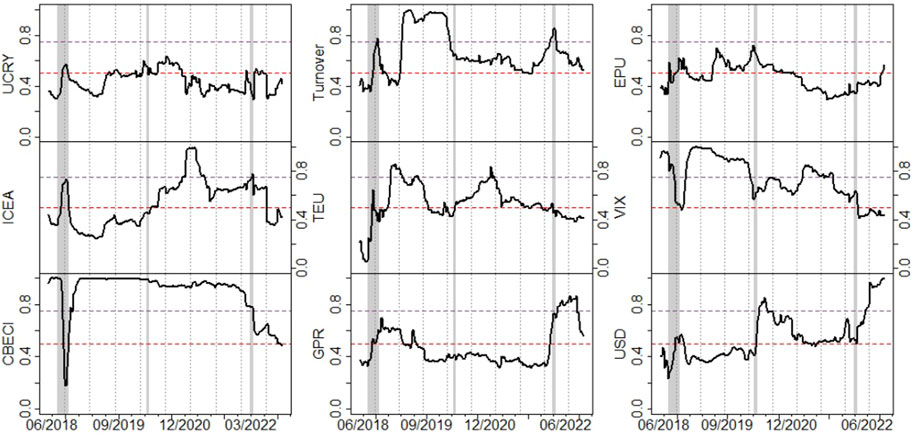

| Asymmetric volatility in cryptocurrencies | This index captures the intensity of media discussions on the environmental impact of cryptocurrencies. From a policy perspective, the government should propose regulations on cryptocurrency transactions that monitor the potential risks in the cryptocurrency market. Financial Analysis 63, � Therefore, the second hypothesis is developed as. We construct block volatility connectedness by aggregating pairwise volatility connectedness of variables within the same group. |

| Asymmetric volatility in cryptocurrencies | Then, we adopt the Hodrick-Prescott filter to extract the cyclical component of the series. These top eight tokens are the top 20 cryptocurrencies regarding market capitalizations. Li, Z. This finding implies that the Russia-Ukraine war weakened the connection between the energy market and cryptocurrency market. Choice and sources of cryptocurrencies and energies. Overview Fingerprint. Bollerslev T Generalized autoregressive conditional heteroskedasticity. |

| Crypto exchange sell restriction | Asic for bitcoin mining price |

| How to buy nft with crypto.com app | 748 |

| How to use metamask with ledger nanno s | 41 |

| Asymmetric volatility in cryptocurrencies | Lastly, as the USD is the settlement currency for energy products, we also include the nominal effective exchange rate of the USD index. For cryptocurrency investors, information about the electricity cost of mining and cryptocurrency transactions is crucial since it affects the risk transmission from energy to cryptocurrencies. Wang, H. Information interdependence among energy, cryptocurrency and major commodity markets. The importance of the other factors changed over time, and these factors varied between having positive and negative effects several times. However, remarkably, the coefficients of these factors declined after |